Overview of Bitcoin Halving

What is Bitcoin Halving? Bitcoin halving is a scheduled event that occurs every four years, where the reward for mining new blocks is halved, meaning miners receive 50% less bitcoins for verifying transactions. This mechanism is built into the design of bitcoin itself to control inflation and extend the longevity of the currency.

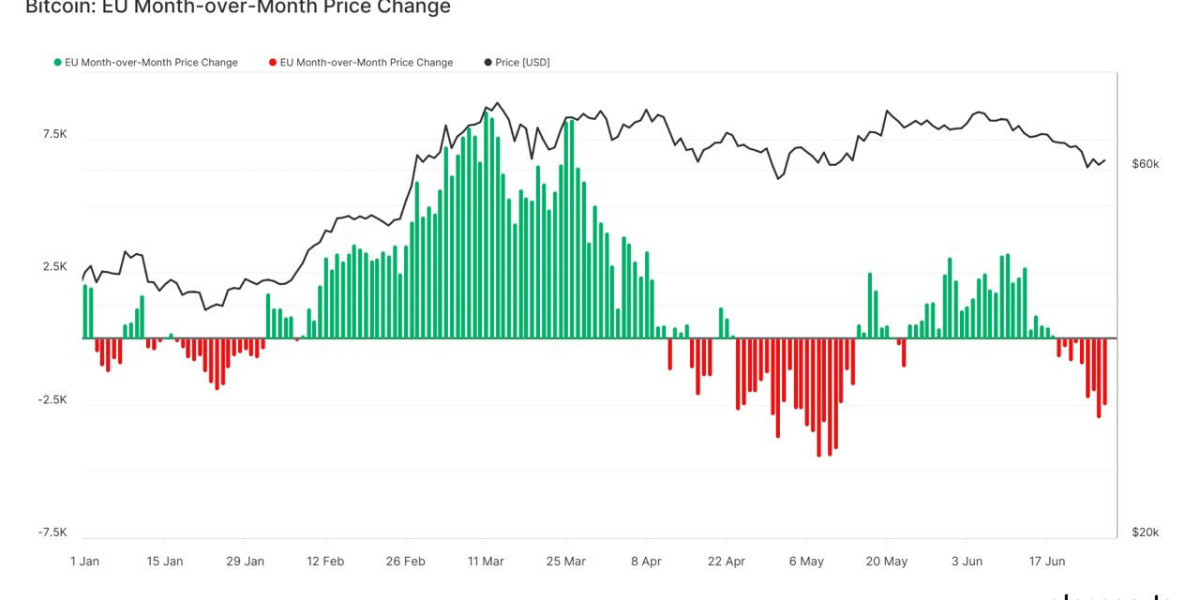

Impact on Price Historically, halving events have precipitated some of the biggest bull runs in Bitcoin's history. It's generally followed by a period of increased price volatility as the market adjusts to the new reward scheme.

Volatility Trends Post-Halving

Data from Recent Months Since the April halving, the volatility of Bitcoin during European trading hours has been significantly higher than usual. Various factors contribute to this phenomenon:

- Market Dynamics: Post-halving, many traders anticipate price increases, leading to speculative trading behaviors.

- Time Zone Overlaps: European hours overlap with late North American trading times and early Asian markets, creating a unique window where significant trading volumes are processed.

- Regulatory News: Europe has been at the forefront of blockchain and cryptocurrency regulation, and any news in this regard can prompt swift market reactions.

Analyzing the Impact

- Increased Trading Volume: There's a noticeable uptick in trading volume during these hours, highlighting heightened market activity.

- Price Swings: Larger price swings can often be observed, which are both a risk and an opportunity for traders.

How Traders Can Adapt

Strategies for Navigating Volatility To cope with the increased volatility, traders might consider the following strategies:

- Enhanced Risk Management: Utilizing stop-loss and take-profit orders can help manage risks associated with high volatility.

- Market Analysis: Keeping abreast of market trends and regulatory news can provide traders with insights necessary for making informed decisions.

Long-Term Implications

What This Means for the Bitcoin Market The heightened volatility post-halving is not just a short-term occurrence. It reflects deeper market trends that could influence the long-term stability and perception of Bitcoin.

- Investor Sentiment: Continuous volatility can affect investor confidence, potentially leading to more conservative investment strategies.

- Market Maturity: As the market adapts to halving events, the reactions may become less pronounced, indicating a maturing market.

Conclusion

The post-halving volatility observed in European trading hours is a multifaceted issue that offers both challenges and opportunities. By understanding these dynamics, traders can better navigate the market, leveraging volatility rather than falling victim to it.

FAQs

What exactly is Bitcoin halving? Bitcoin halving is an event where the reward for mining new blocks is reduced by half, which occurs approximately every four years.

Why does volatility increase during European trading hours? This increase is likely due to the overlap of multiple time zones, which results in higher trading volumes and, consequently, greater price fluctuations.

How can traders prepare for increased volatility? Traders can employ more rigorous risk management techniques and stay informed about market conditions to make savvy trading decisions.

Will Bitcoin's volatility decrease in the future? Volatility is expected to decrease as the market matures and more institutional investors get involved, leading to greater stability.

How does halving impact Bitcoin's price in the long term? Historically, halving events have led to price increases as the reduced supply of new bitcoins heightens demand.