As the summer heats up, energy consumption spikes, and with it, the costs. In the world of cryptocurrency mining, these rising power rates are a significant concern. Luxor COO recently predicted further declines in the hash rate, the measure of computational power used in mining, due to these rising costs. Let's dive into why this is happening, what it means for the crypto industry, and how miners are navigating these challenges.

Understanding Hash Rate and Its Importance

What is Hash Rate?

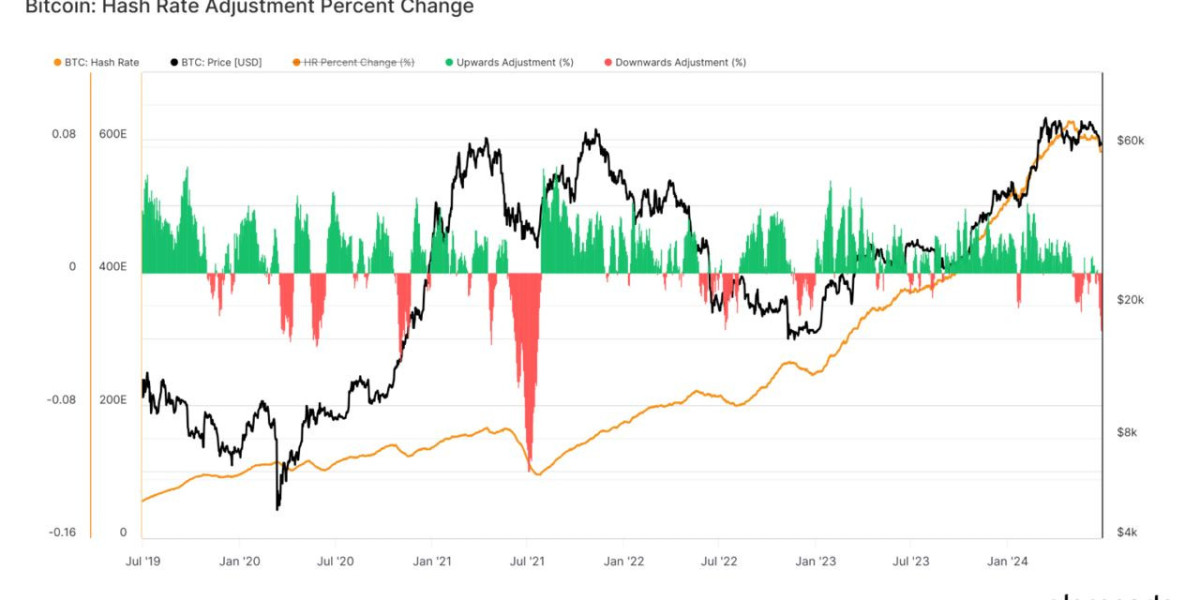

The hash rate is a critical metric in the world of cryptocurrency mining. It represents the total computational power being used to mine and process transactions on a blockchain network. A higher hash rate means more miners are working on the network, which enhances its security and efficiency.

Why is Hash Rate Important?

- Security: A higher hash rate makes the network more secure by making it more difficult for any single entity to take control.

- Transaction Speed: More computational power means transactions are processed faster.

- Network Stability: A high and stable hash rate indicates a healthy and active mining community.

The Impact of Rising Summer Power Rates

Summer Power Rates: A Seasonal Challenge

Every summer, power rates tend to rise due to increased demand for electricity. This is particularly challenging for cryptocurrency miners, who rely heavily on electricity to power their mining rigs.

How Rising Power Rates Affect Mining

- Increased Costs: Higher power rates directly increase the operational costs for miners.

- Profit Margins: With higher costs and fixed revenue per mined block, profit margins shrink.

- Hash Rate Decline: As costs rise, some miners may shut down their operations, leading to a decline in the overall hash rate.

Luxor COO's Forecast

Predicted Hash Rate Decline

Luxor COO has forecasted a further decline in the hash rate amid the rising summer power rates. This prediction is based on the historical trend of power rates affecting mining operations and the current market conditions.

Factors Influencing the Forecast

- Energy Prices: Current and projected energy prices during the summer months.

- Mining Profitability: The balance between the cost of mining and the price of cryptocurrencies.

- Market Trends: General trends in the cryptocurrency market, including investor sentiment and regulatory changes.

Strategies for Miners to Navigate Rising Costs

Optimizing Operations

- Energy Efficiency: Upgrading to more energy-efficient mining hardware.

- Cooling Solutions: Implementing advanced cooling solutions to reduce energy consumption.

- Location Choices: Relocating operations to regions with lower energy costs.

Financial Strategies

- Hedging: Using financial instruments to hedge against rising energy costs.

- Diversifying: Diversifying mining activities to include more profitable cryptocurrencies.

Technological Innovations

- Renewable Energy: Investing in renewable energy sources to power mining operations.

- Advanced Algorithms: Using advanced algorithms to optimize mining efficiency.

Conclusion

Rising summer power rates pose a significant challenge to cryptocurrency miners, potentially leading to a decline in hash rates. However, by adopting strategic operational and financial measures, miners can navigate these challenges and continue to sustain their operations. The crypto mining industry must continuously adapt to external factors like energy costs to maintain profitability and stability.

FAQs

1. What is hash rate in cryptocurrency mining?

Hash rate refers to the total computational power being used to mine and process transactions on a blockchain network.

2. Why do power rates rise in the summer?

Power rates typically rise in the summer due to increased demand for electricity as people use more energy to cool their homes and businesses.

3. How do rising power rates affect cryptocurrency mining?

Rising power rates increase the operational costs for miners, which can reduce profit margins and lead to a decline in the overall hash rate.

4. What strategies can miners use to mitigate rising power costs?

Miners can optimize their operations for energy efficiency, implement advanced cooling solutions, relocate to regions with lower energy costs, hedge against rising costs, and invest in renewable energy sources.

5. What did Luxor COO predict about the hash rate?

Luxor COO forecasted a further decline in the hash rate amid rising summer power rates due to increased operational costs and other market factors.