As the expiry dates for $6.6 billion in Bitcoin (BTC) options and $3.4 billion in Ethereum (ETH) options approach, the crypto market is keenly observing the potential impact on price movements. These expiries, particularly the concept of "max pain" price points, play a crucial role in understanding market sentiment and possible price stabilization or volatility.

Introduction to Options Expiry in Crypto Markets

Options are financial instruments that give holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. The expiry of these options often leads to significant price fluctuations in the market, as traders adjust their positions based on their expectations and market trends.

The Concept of Max Pain in Options

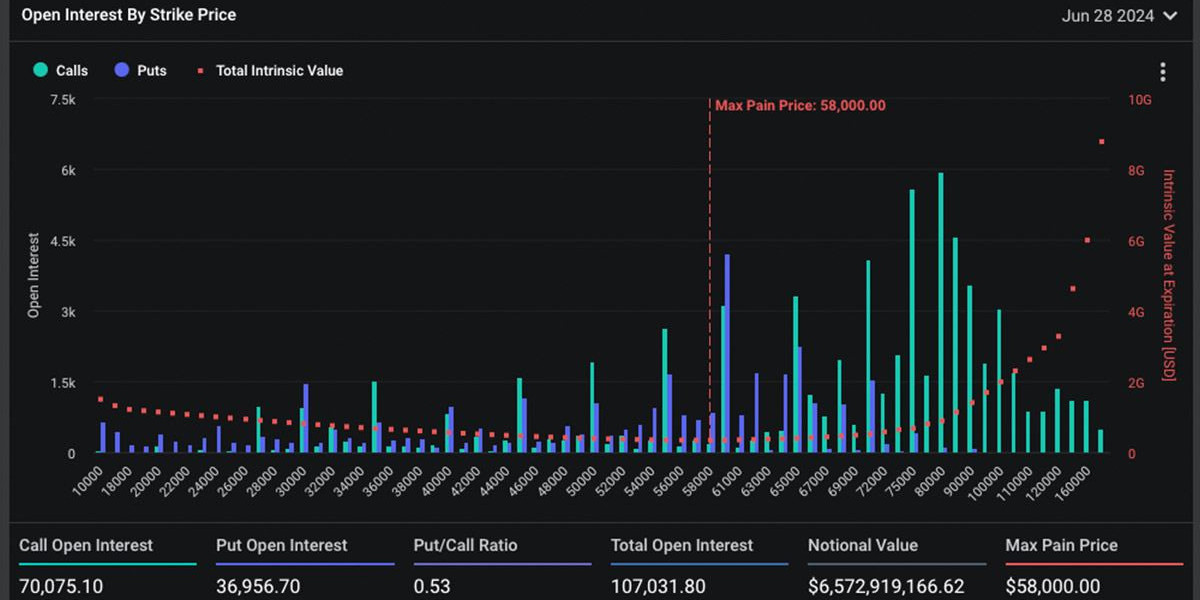

The max pain point is the strike price at which the highest number of options (both calls and puts) would expire worthlessly, causing maximum financial loss to the option holders. This price is closely watched because market prices tend to gravitate towards the max pain point as expiry approaches.

BTC and ETH Max Pain Prices

For the upcoming expiry, the max pain price for Bitcoin is currently pegged at a specific level, which suggests that the market might stabilize near this price as traders hedge their positions. Similarly, Ethereum's max pain price indicates where the largest number of options would expire worthlessly, potentially guiding ETH's price movement.

Impact of $6.6 Billion BTC and $3.4 Billion ETH Options Expiry

Market Volatility and Price Effects

As expiry nears, the increased activity associated with closing, rolling over, or settling these options positions can lead to heightened volatility in BTC and ETH prices. Market participants often adjust their holdings to mitigate risks or capitalize on expected price movements caused by these expiries.

Strategic Considerations for Traders

Traders might use strategies like straddles or strangles to profit from the expected volatility, or they may choose more conservative approaches, such as covered calls or protective puts, to manage their exposure during these periods.

Broader Implications for the Crypto Market

The significant value of expiring options underscores the growing influence of derivative markets in the crypto sector. As these markets mature, their impact on the underlying asset prices becomes more pronounced, influencing overall market dynamics.

Regulatory and Investor Attention

With the increasing volume of options expiries, regulatory bodies and institutional investors are paying closer attention to the crypto derivatives market. This scrutiny can lead to more standardized practices and potentially more stability in the long term.

Conclusion

The upcoming expiry of substantial BTC and ETH options holds critical implications for market behavior. By understanding and anticipating the effects of max pain prices, traders and investors can better navigate the potential volatility and align their strategies accordingly.

FAQs About BTC and ETH Options Expiry

What are BTC and ETH options? Options are derivatives that provide the right to buy or sell BTC or ETH at a predetermined price before a certain date.

What is max pain in options trading? Max pain refers to the strike price at which the highest number of options would expire worthlessly, minimizing the payout to option holders.

How do options expiry impact BTC and ETH prices? The expiry can lead to increased volatility as traders adjust their positions to mitigate risks or capture benefits from expected price movements.

What strategies do traders use during options expiry? Traders may use various strategies, including straddles, strangles, covered calls, and protective puts, to manage their exposure.

Why is the options market significant for BTC and ETH? It plays a crucial role in price discovery and market sentiment, influencing both short-term price movements and longer-term market trends.