Overview of Bitcoin ETFs and GBTC

Bitcoin ETFs provide investors with an opportunity to invest in Bitcoin through traditional investment vehicles, without the need to directly purchase and hold the cryptocurrency. This approach offers advantages such as ease of access, reduced custody risks, and integration into traditional portfolios.

Understanding GBTC's Role

Grayscale Bitcoin Trust (GBTC) is one of the oldest and largest Bitcoin funds, allowing investors to gain exposure to Bitcoin's price movements without the complexities of buying and storing the actual cryptocurrency.

GBTC's Unique Market Position

Unlike newer Bitcoin ETFs, GBTC operates with a fixed supply, meaning new shares are not created in response to demand. This can lead to price premiums or discounts relative to Bitcoin's actual market price.

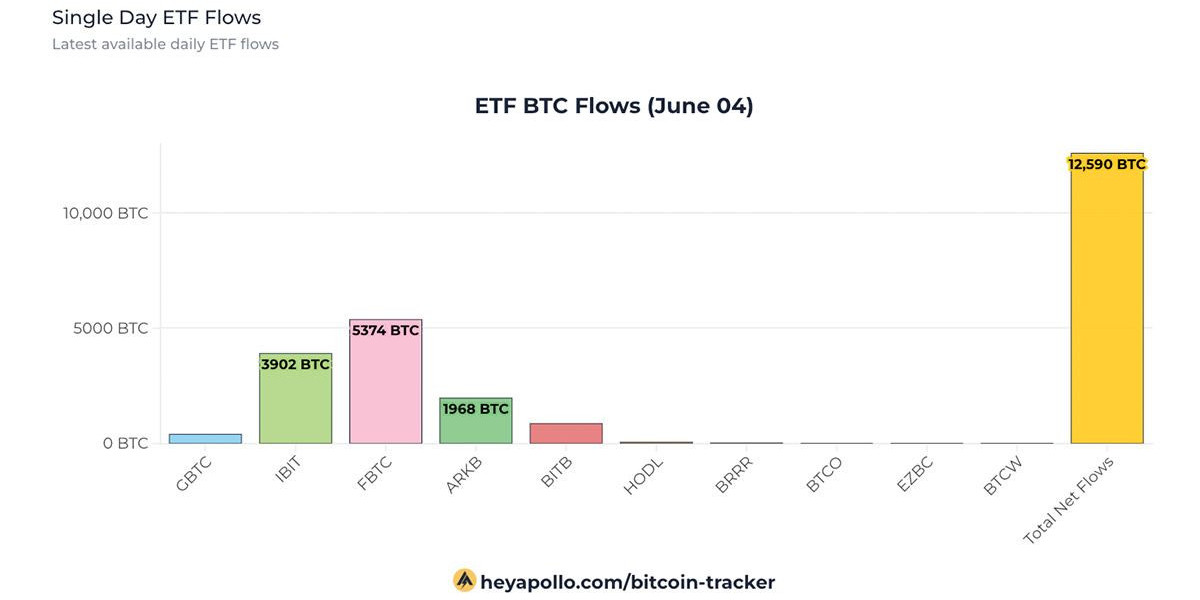

Analysis of the $887 Million Inflow

The recent $887 million inflow into Bitcoin ETFs represents a significant confidence boost from investors. This section explores the dynamics behind these inflows and the absence of outflows from GBTC.

Factors Contributing to the Inflow

- Increased Institutional Interest: Large-scale investors and institutions are showing a growing interest in cryptocurrency as a legitimate asset class.

- Market Recovery Signals: Recent trends suggest a recovery in the crypto market, prompting investors to increase their stakes.

- Diversification Strategies: Investors are increasingly looking at Bitcoin as a hedge against inflation and currency devaluation.

The Impact of Zero Outflows from GBTC

The lack of outflows from GBTC highlights investors' long-term confidence in Bitcoin. This stability is crucial for maintaining a positive market sentiment and could influence future pricing trends.

Implications for Investors and the Market

This influx of funds and the sustained interest in GBTC have several implications for both retail and institutional investors.

Strategic Considerations for Investors

- Assessing Risk and Return: Investors should consider the volatility of Bitcoin and the impact of market movements on ETFs and funds like GBTC.

- Long-term Investment Outlook: The growing inflows might indicate a shift towards viewing Bitcoin as a long-term investment rather than for speculative short-term gains.

The Role of Regulatory Developments

Regulatory changes and potential new guidelines for cryptocurrency investments could significantly impact the market dynamics and investor sentiment.

The Future of Cryptocurrency Investments

As Bitcoin continues to mature as an asset class, the role of ETFs and products like GBTC will be pivotal in shaping the accessibility and attractiveness of cryptocurrency investments.

Predictions and Trends

- Expansion of Bitcoin ETF Offerings: More financial institutions are likely to introduce Bitcoin-related investment products.

- Increased Regulatory Clarity: As regulatory frameworks around cryptocurrencies become clearer, investor confidence is expected to grow, potentially leading to more stable inflows.

Conclusion: A Turning Point in Crypto Investments

The significant inflows into Bitcoin ETFs and the stability of GBTC are indicative of a broader acceptance of Bitcoin in the investment community. This could mark a turning point in how cryptocurrencies are viewed and utilized in investors' portfolios.

FAQs After the Conclusion

What are Bitcoin ETFs?

- Bitcoin ETFs are investment funds that track the price of Bitcoin and are traded on traditional stock exchanges.

Why are there zero outflows from GBTC?

- The zero outflows from GBTC suggest strong investor confidence and a preference for holding onto the investment amidst market recovery.

What does the $887 million inflow signify?

- The $887 million inflow into Bitcoin ETFs indicates robust investor interest and confidence in the cryptocurrency market.

How does GBTC differ from other Bitcoin ETFs?

- GBTC differs because it has a fixed supply of shares and doesn’t create new shares in response to demand, unlike typical ETFs.

What should investors consider before investing in Bitcoin ETFs?

- Investors should consider their risk tolerance, the volatility of Bitcoin, and the potential impact of regulatory changes on cryptocurrency markets.